what is fit tax on paycheck

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Also the 16630 added to wages doesnt affect the social.

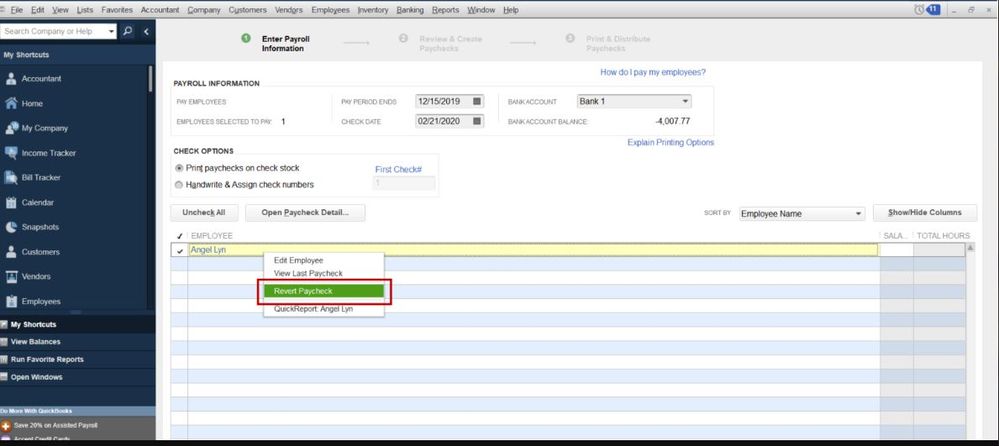

Calculation Of Federal Employment Taxes Payroll Services

The 2021 credit can be up to 6728 for taxpayers with three or more children or lower amounts for taxpayers with two one or no children.

. 10 12 22 24 32 35 and 37. 2022 Federal Income Tax Brackets and Rates. Your bracket depends on your taxable income and filing status.

If you withhold at the single rate or at the lower married rate. Like last year the federal withholding tax table you use depends on which version of Form W-4 an employee filled out and. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

Federal income tax is withheld from an employees earnings such as regular pay bonuses and commissions in addition to other types of earnings. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities. On your paycheck it will show how much your federal income taxes are under the term federal withholding.

The information you give your employer on Form W4. See how your refund take-home pay or tax due are affected by withholding amount. For help with your withholding you may use the Tax Withholding Estimator.

If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22. In this example the employer would withhold 33 in federal income tax from the weekly wages of the nonresident alien employee. For most people FIT are the taxes that employers are expected to withhold from your paycheck.

If we add up the two tax amounts. Each allowance you claim reduces the amount withheld. 4664 548350 1014750 total FIT to be withheld from all checks this year.

There are two federal income tax withholding methods for use in 2021. The amount of income you earn. And due to the 2020 changes surrounding the repeal of withholding allowances and the redesign of Form W-4 you might still have questions about which table to reference.

In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E. It depends on. As your income.

The 16630 added to wages for calculating income tax withholding isnt reported on Form W-2 and doesnt increase the income tax liability of the employee. Income taxes are taxes on income both earned salaries wages tips commissions and unearned interest dividends. 69400 wages 44475 24925 in wages taxed at 22.

How It Works. FITW is an abbreviation for federal income tax withholding. The federal income tax is the largest source of revenue for the federal government.

Estimate your federal income tax withholding. This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period. The amount of income tax your employer withholds from your regular pay depends on two things.

The list below describes the most common federal income tax credits. Withholding is one way of paying income taxes to the federal government before your end-of-the-year tax filing2 мая 2018 г. Wage bracket method and percentage method.

The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. Federal income taxes are calculated and withheld when an employee is paid. The withholdings are then remitted to the IRS on a regular basis depending on the employers payroll schedule.

This is 548350 in FIT. How many withholding allowances you claim. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Youll sometimes see it on payroll stubs to identify your withholding deductions. There are seven federal income tax rates in 2022. Choose an estimated withholding amount that works for you.

The top marginal income tax rate of. There are seven federal tax brackets for the 2021 tax year. Use this tool to.

The federal income tax table brackets change annually. All wages salaries cash gifts from employers business income tips gambling income bonuses and unemployment benefits are subject to a federal income tax. However some of your income will be taxed at the lower tax brackets 10 and 12.

The amount you earn. For employees withholding is the amount of federal income tax withheld from your paycheck.

Here S How To Read A Pay Stub With Sample Paycheck Youtube

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Payroll Template Free Payslip Templates

Solved No Medicare Or Social Security Tax Taken Out Of One Employee S Check

Why Do People Say That Half Your Salary Goes To Taxes In Canada Say Your Income Is 100k Should You Expect To Take Home 4k Per Month After Taxes Quora

W 2 Software W 2 Software To Create Print E File Irs Form W 2

Washington Paycheck Calculator Smartasset

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Taxes On Payroll Store 58 Off Www Ingeniovirtual Com

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Non Profit Treasurer Report Template Inspirational Free Excel Treasurer Report Template Capable Problem Report Template Templates Non Profit

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Taxes On Payroll Store 58 Off Www Ingeniovirtual Com